Submit Your VAT Returns

Direct to HMRC

Making Tax Digital compliant software for UK VAT-registered businesses

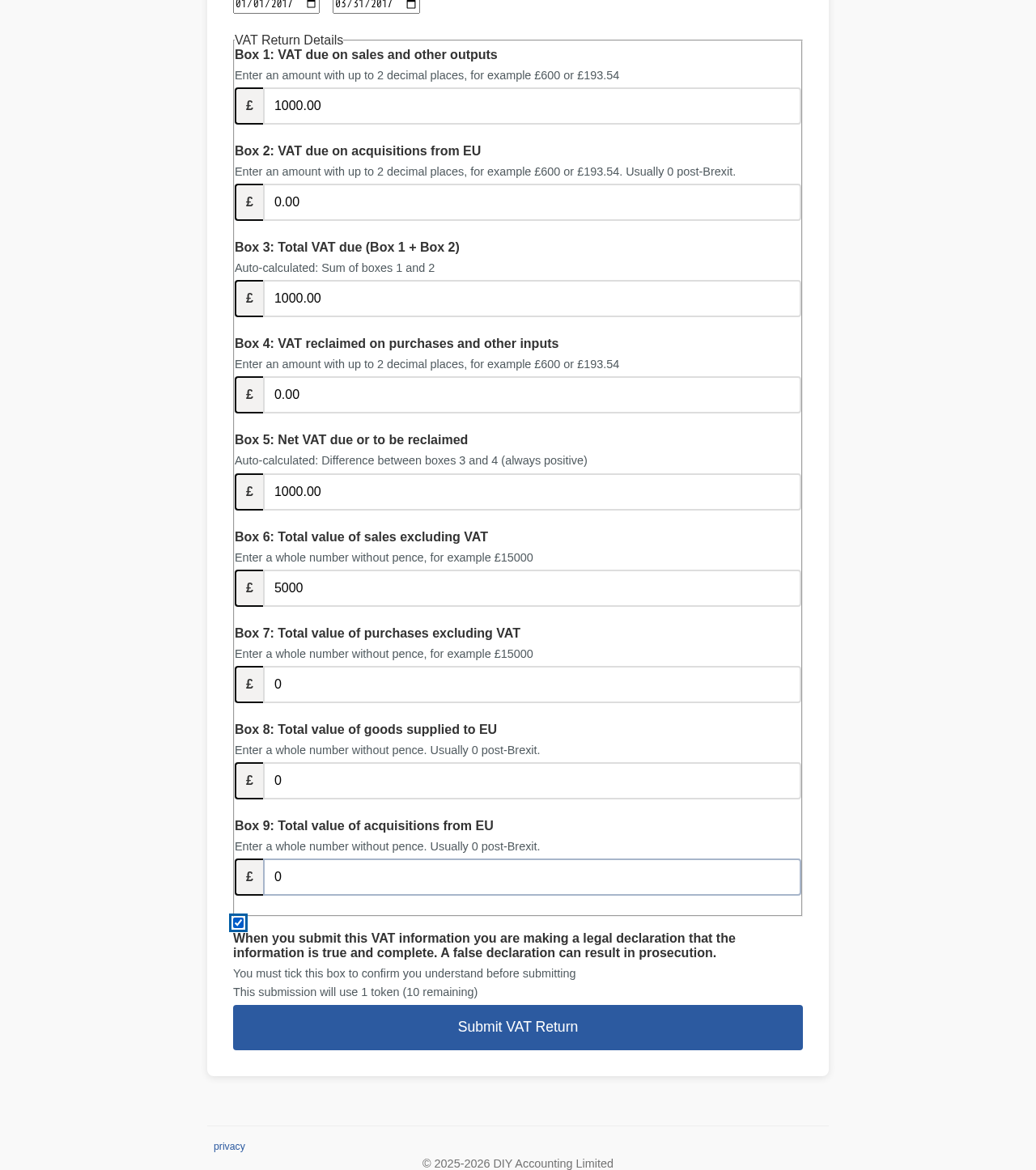

Simple VAT Return Form

Enter your figures in the familiar 9-box format. Boxes 3 and 5 calculate automatically. Clear labels and hints help you enter the right values.

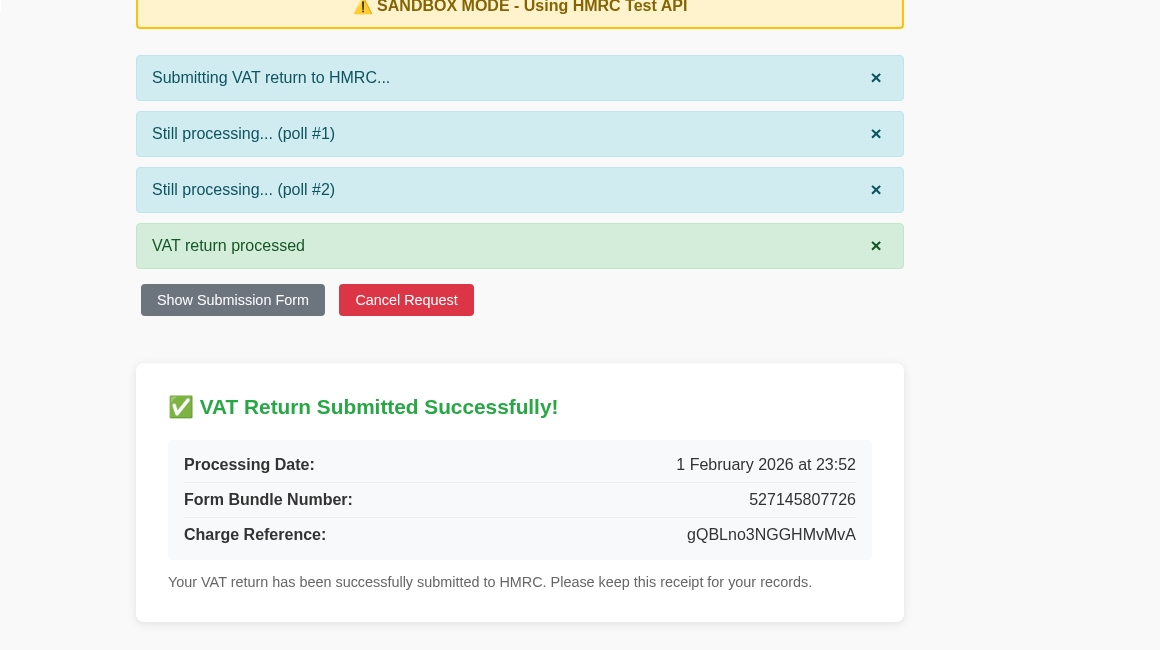

Instant HMRC Confirmation

Get immediate confirmation when HMRC accepts your return. Your receipt includes the Form Bundle Number as official proof of submission.

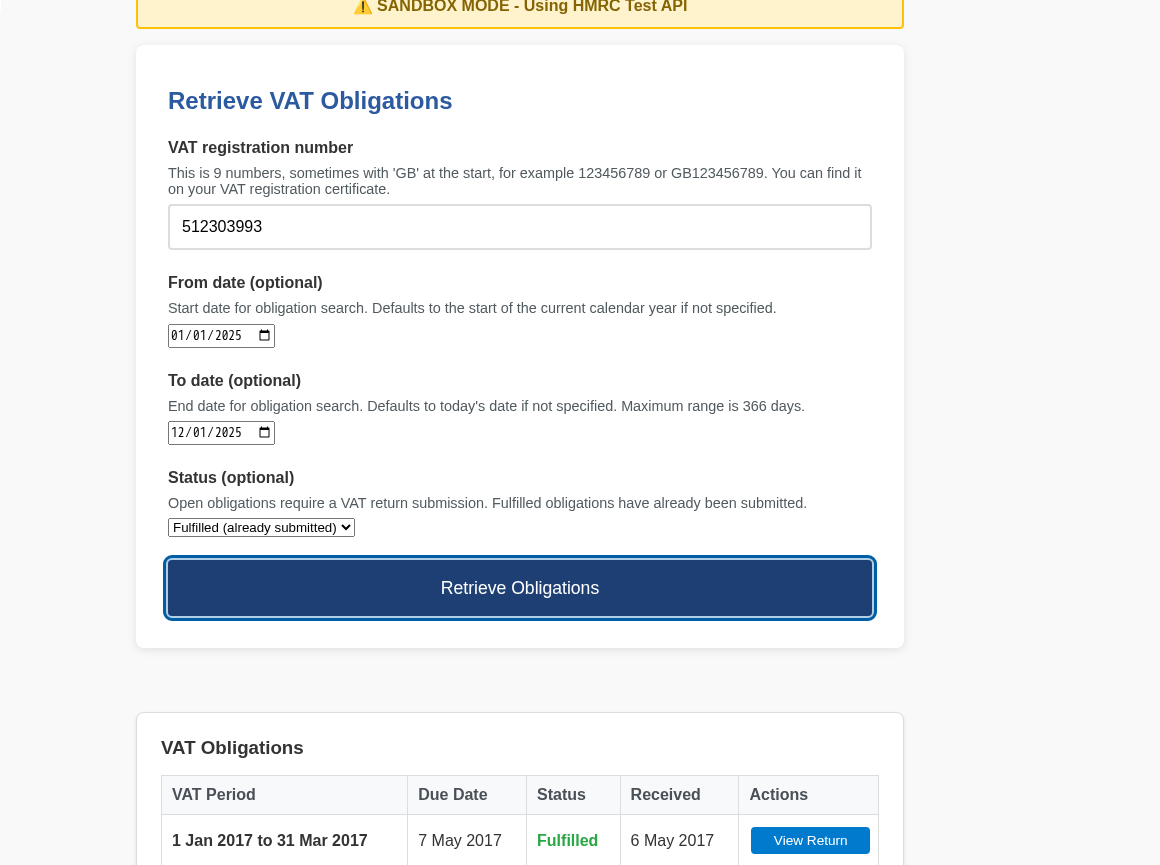

Track Your Obligations

See exactly which VAT periods need returns and their due dates. Never miss a deadline with a clear view of open and fulfilled obligations.

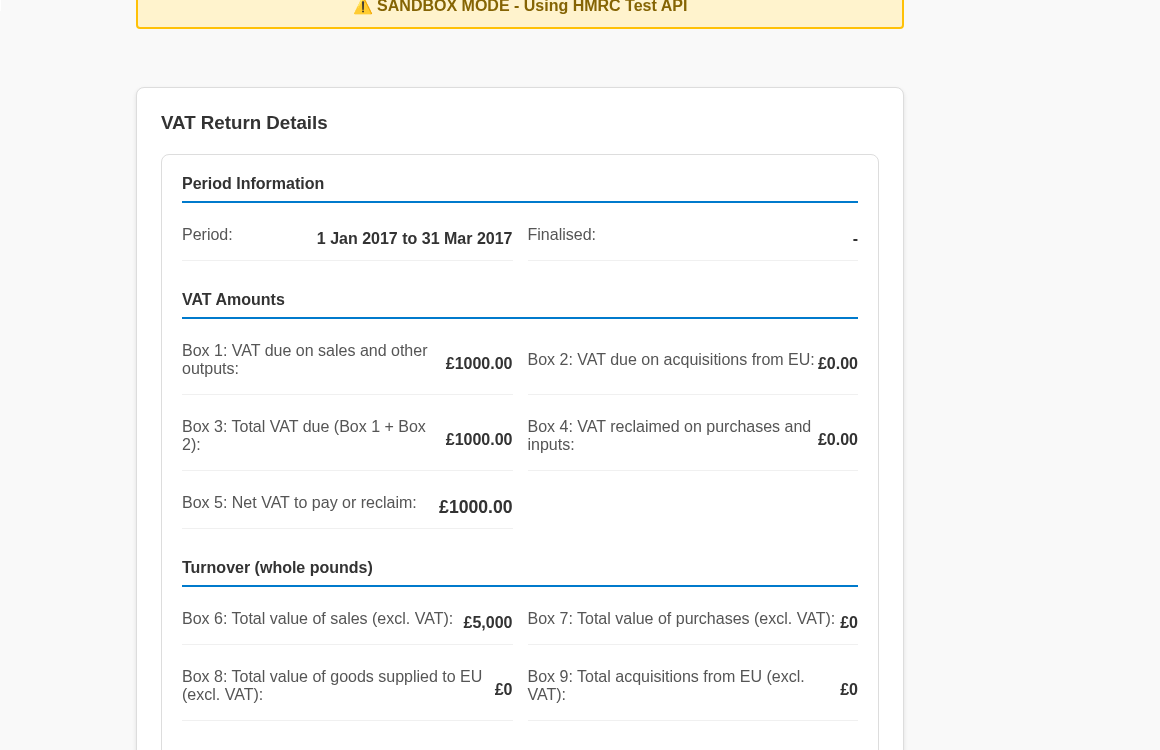

View Submitted Returns

Retrieve any previously submitted return directly from HMRC. Verify your figures were recorded correctly at any time.

Why Choose DIY Accounting Submit?

Free Guest Tier

Request a Day Guest bundle for free access with 3 tokens, valid for 24 hours. Each VAT submission uses 1 token. Invited guests receive a pass code granting longer access. Visit the Bundles page to manage your access.

HMRC Recognised

Fully compliant with Making Tax Digital for VAT. Authorised to submit directly to HMRC.

Bridging Software

Keep using your spreadsheet or accounting software. Just enter your final figures here to submit.

Accessible Design

Built to WCAG 2.2 Level AA standards. Works with screen readers and keyboard navigation.

Ready to Submit Your VAT Return?

Log in with your Google account to get started. You'll need your Government Gateway credentials when authorising with HMRC.