Submit your VAT return in 3 steps

This guide walks you through checking your VAT obligations, entering your figures, and submitting to HMRC.

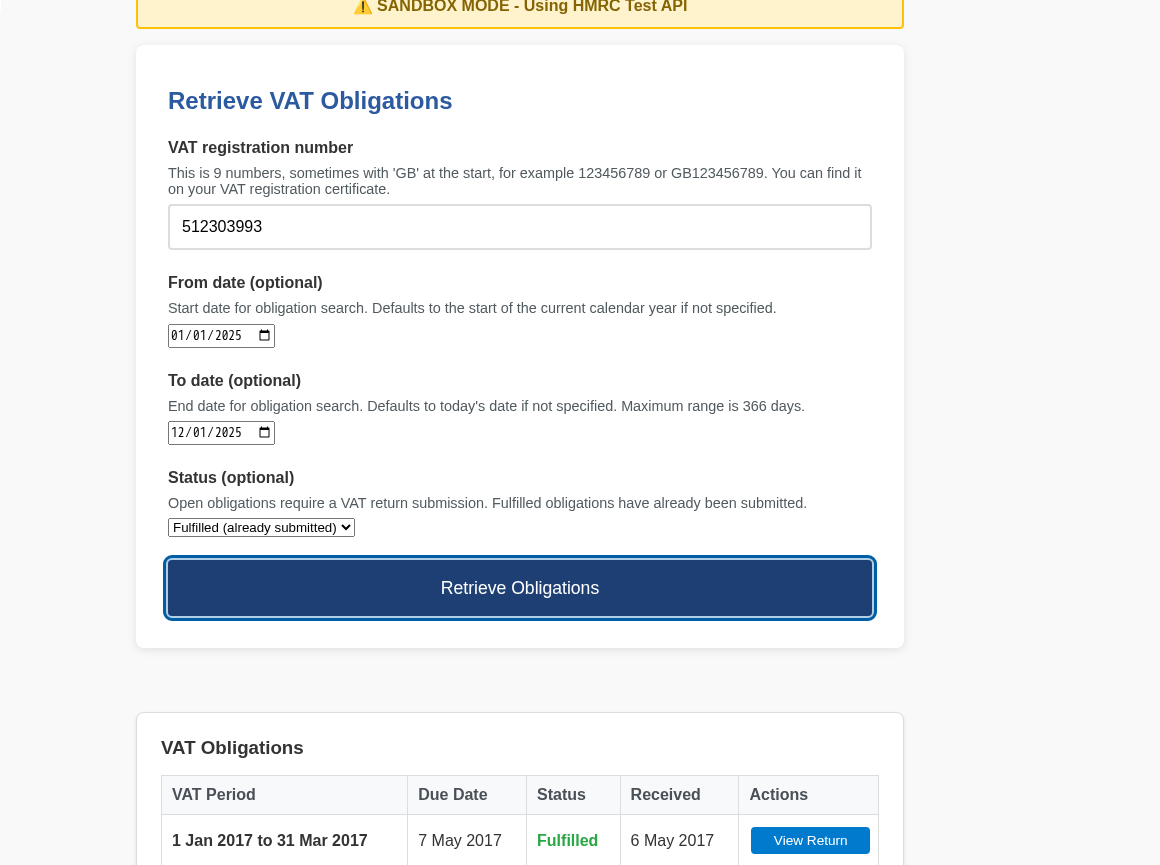

1 Check Your VAT Obligations

Before submitting, check which VAT periods HMRC expects returns for. Open obligations show periods where you haven't yet submitted.

VAT Obligations shows your VAT periods. Each row displays the period dates, due date, and whether the return

is Open (needs submitting) or Fulfilled (already submitted). Click Submit Return to start a submission for an

open period.

How to check obligations

- Click Check VAT Obligations from the home page

- Enter your 9-digit VAT registration number

- Adjust the date range if needed (defaults to the current year)

- Click Retrieve Obligations

- Look for periods with Open status - these need returns

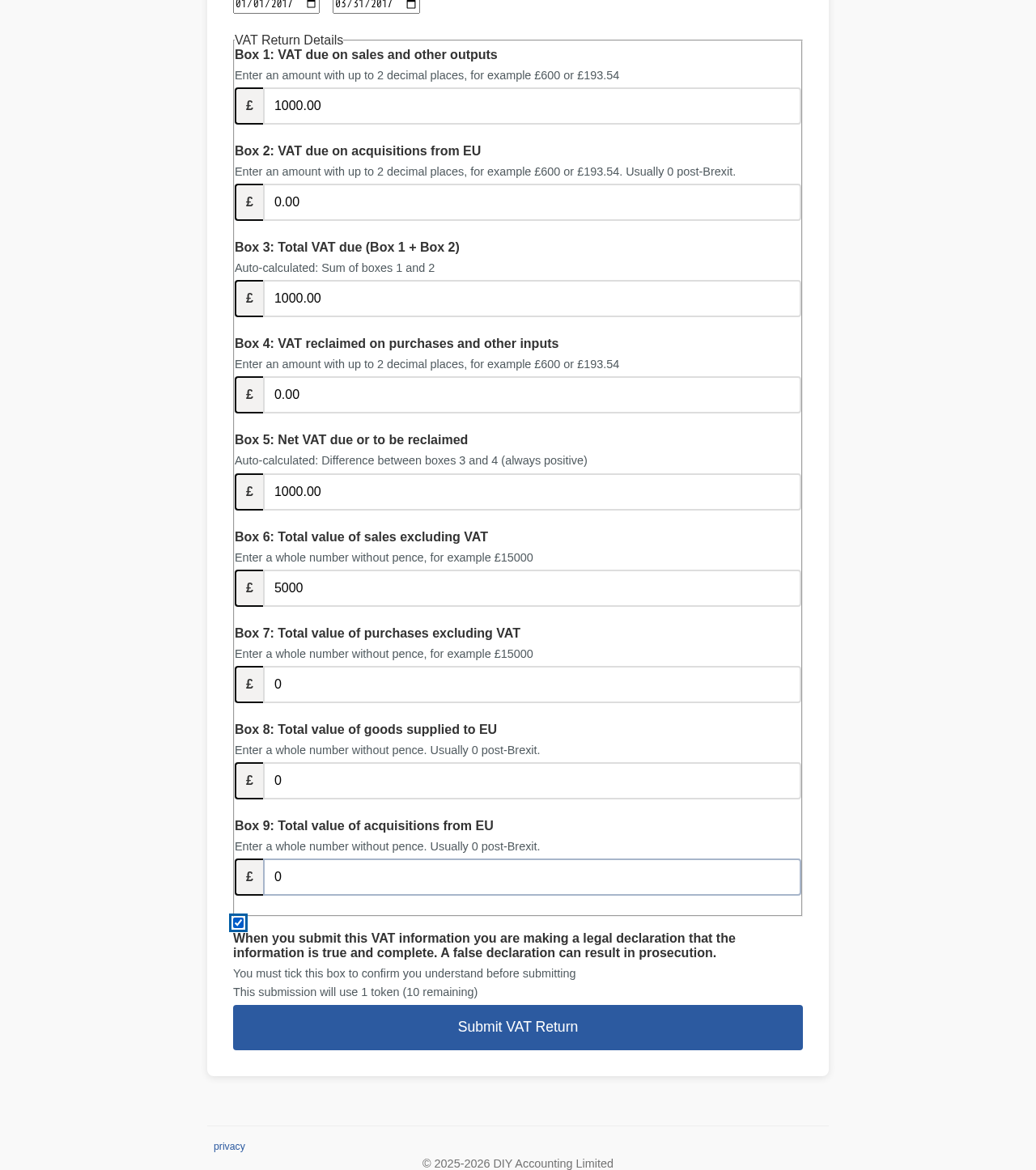

2 Submit Your VAT Return

Enter your VAT figures in Boxes 1-9. Boxes 3 and 5 calculate automatically based on your other entries.

VAT Return Submission form - Enter your figures from your accounting records. Box 1 is VAT on sales, Box 4 is

VAT you can reclaim, and Boxes 6-9 are turnover values in whole pounds.

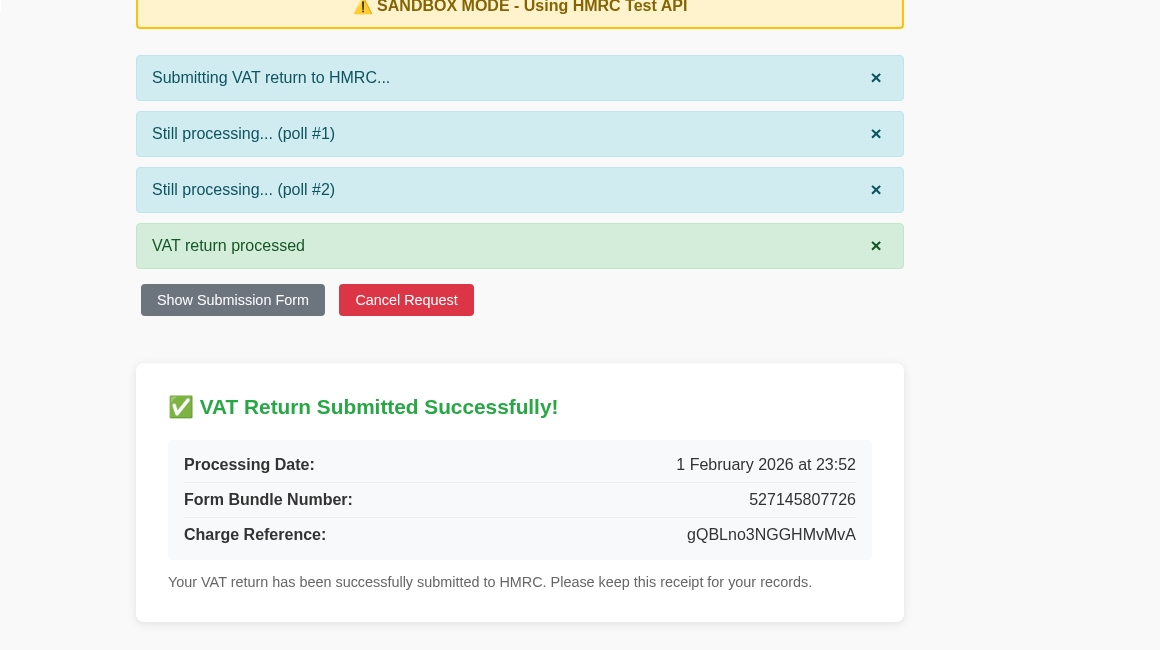

Success! After HMRC accepts your return, you'll see a receipt with your Form Bundle Number. Save or print

this as proof of submission. The processing date confirms when HMRC received it.

How to submit your return

- Click Submit VAT Return from the home page

- Enter your VAT registration number and select the VAT period

-

Enter your figures:

- Box 1: VAT due on sales and other outputs

- Box 2: VAT due on acquisitions from EU (usually £0)

- Box 4: VAT reclaimed on purchases and other inputs

- Boxes 6-9: Turnover and EU trade values (whole pounds)

- Tick the declaration checkbox to confirm the information is true

- Click Submit - you'll be redirected to HMRC to authorise

- Log in with your Government Gateway credentials and grant permission

- Save your receipt showing the Form Bundle Number

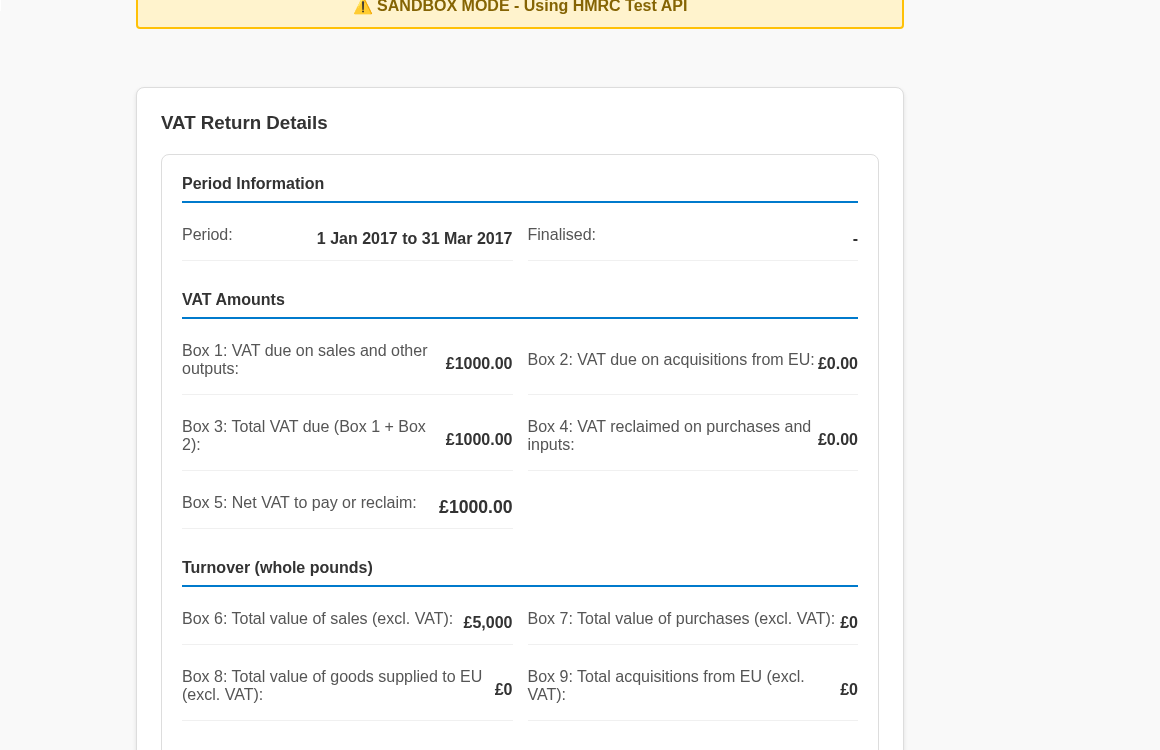

3 View Your Submitted Return

After submission, you can retrieve your return from HMRC to verify the figures were recorded correctly.

View VAT Return shows exactly what HMRC has on record. Use this to confirm your submission was recorded

correctly. All 9 boxes are displayed along with the period dates.

How to view a submitted return

- Click View VAT Return from the home page

- Enter your VAT registration number

- Select the period you want to view

- Click Retrieve to see HMRC's record of your return

Finding Your Receipts

Your submission receipts are saved securely in your account. Access them anytime from the Receipts link in the navigation bar to see your submission history.

Important notes about receipts

- Receipts are stored securely in your account and accessible from any device

- Log in to view your submission history

- Your receipt includes the Form Bundle Number - quote this to HMRC if you ever need to prove submission