DIY Accounting Products

DIY Accounting provides Excel bookkeeping and accounting spreadsheets for the UK small business market. Designed by a Chartered Management Accountant, each product is a self-contained set of Excel workbooks covering sales, purchases, profit and loss, and tax calculations appropriate to your business type.

All products are compatible with Microsoft Excel and OpenOffice Calc. They are available as immediate downloads and include step-by-step user guides.

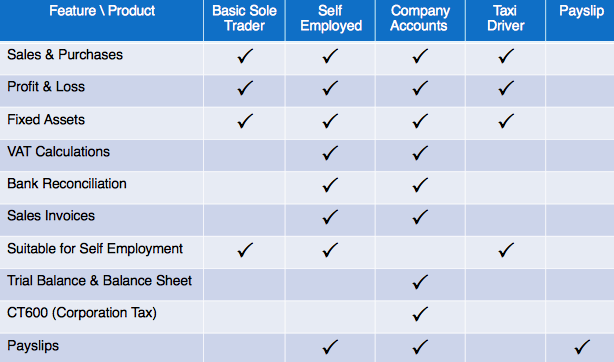

Feature comparison across the DIY Accounting product range

Basic Sole Trader

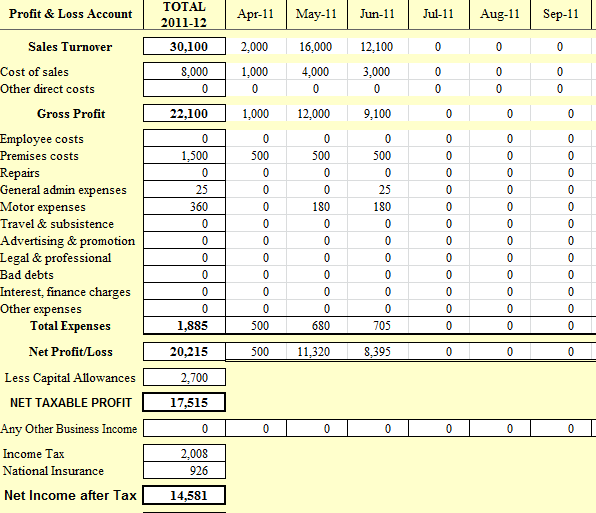

The simplest accounting package for sole traders who are not VAT registered and have no employees. Includes sales and purchases spreadsheets with an automated profit and loss account and self-employed short tax return.

- Sales spreadsheet

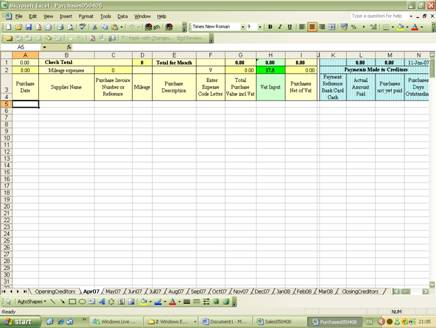

- Purchases spreadsheet

- Profit & loss account

- Self-employed tax return

- Income tax calculation

Self Employed

Easy-to-use accounting software for anyone self employed, whether VAT registered or not, with or without employees. Produces both the short and full self-employed tax returns along with quarterly VAT returns.

- Sales spreadsheet

- Sales invoices

- Purchases spreadsheet

- Cash & bank reconciliation

- VAT returns

- Profit & loss account

- Self assessment tax return

- Payslips

Company Accounts

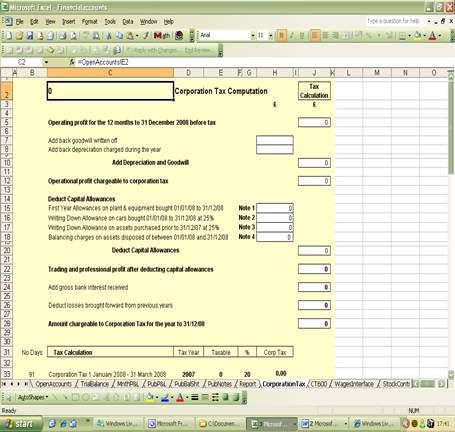

Small business accounting software for limited liability companies, whether VAT registered or not, with or without employees. Uses double-entry bookkeeping and produces quarterly VAT returns, profit and loss accounts, balance sheets, year-end accounts for Companies House, and CT600 corporation tax calculations.

- Sales spreadsheet

- Sales invoices

- Purchases spreadsheet

- Cash & bank reconciliation

- VAT returns

- Profit & loss account

- Balance sheet

- Final accounts

- Corporation tax (CT600)

- Fixed assets & capital allowances

- Payslips (5, 10, or 20 employees)

Taxi Driver (Cabsmart)

Practical bookkeeping software designed for self-employed taxi drivers, private hire, van drivers, and couriers. Automatically compares mileage allowances against actual vehicle running costs and selects the most tax-efficient method for your expenses claim.

- Income & expenses tracking

- Mileage allowance calculation

- Vehicle expense comparison

- Profit & loss account

- Self-employed tax return

- Fixed assets & capital allowances

- Income tax estimation

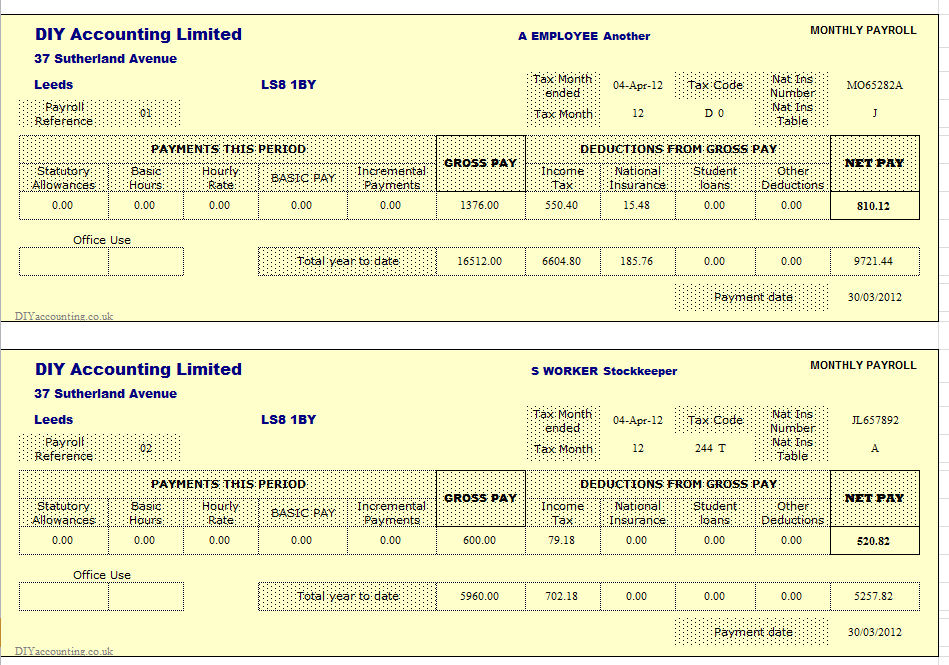

Payslips

A payslip generator for businesses that use a separate tax calculator such as HMRC's Basic PAYE Tools. Enter the tax and National Insurance figures and the spreadsheet produces printed payslips on plain paper with a running total of wages and deductions throughout the year.

- Weekly or monthly payslips

- Plain paper printing

- Running yearly totals

- Compatible with HMRC Basic PAYE Tools

Download

All DIY Accounting spreadsheet products are available for immediate download from the main site.

Visit diyaccounting.co.uk to download