Accounting & Payroll Spreadsheets

DIY Accounting provides Excel bookkeeping and accounting spreadsheets for the UK small business market. Designed by a Chartered Management Accountant, these spreadsheets offer a straightforward approach to managing your business finances without the complexity of traditional accounting software.

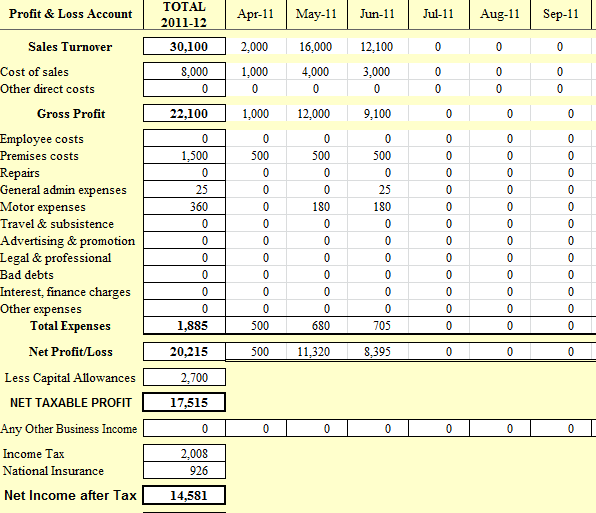

Each product is a self-contained set of Excel workbooks covering sales, purchases, profit and loss, and tax calculations appropriate to your business type. The spreadsheets produce the figures you need for your tax returns and financial accounts.

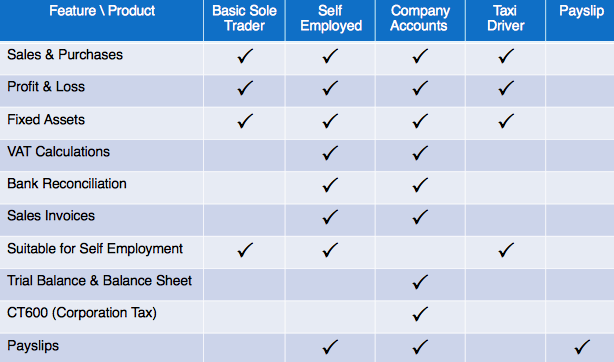

Feature comparison across the DIY Accounting product range

Basic Sole Trader

The simplest personal accounting software for sole traders who are not VAT registered and have no employees. Includes a sales spreadsheet, purchases spreadsheet, and financial accounts producing a profit and loss account and self employed short tax return figures.

Self Employed

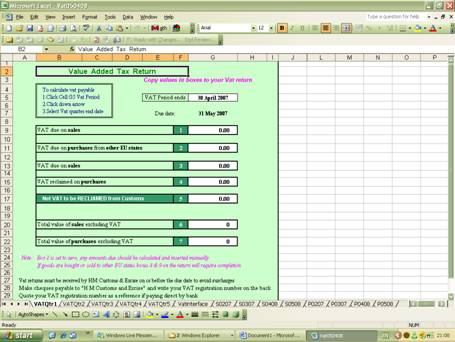

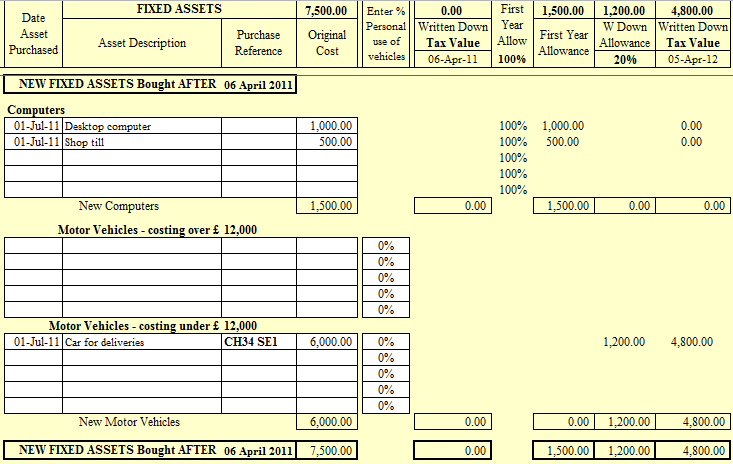

For self-employed individuals and partnerships, with or without VAT registration. Covers sales and purchase accounting, profit and loss statements, fixed assets tracking, VAT calculations, and bank reconciliation. Produces the figures needed for your self assessment tax return.

Company Accounts

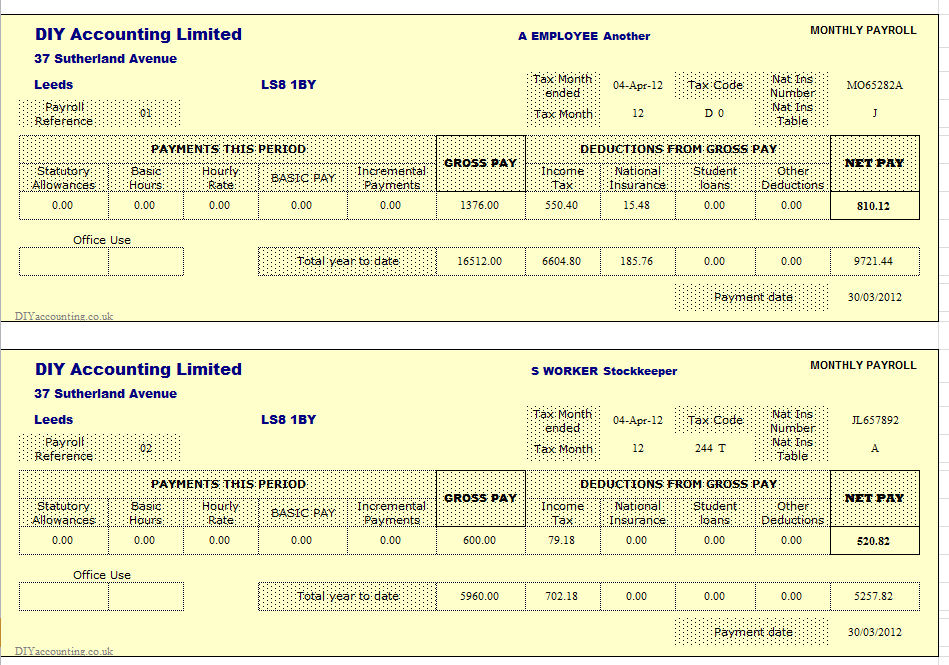

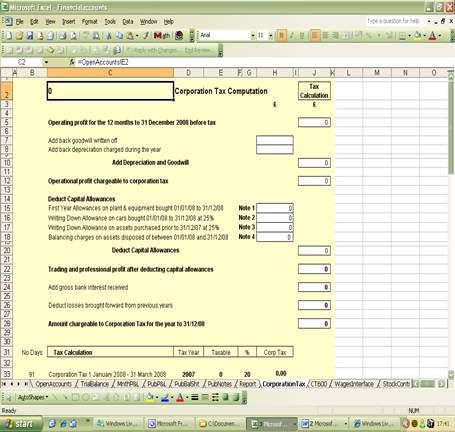

For limited liability companies, whether VAT registered or not, with or without employees. Uses double-entry bookkeeping integrated with payroll software. Produces VAT returns, profit and loss accounts, balance sheets, year-end accounts for Companies House, and CT600 corporation tax calculations.

Taxi Driver

Specialised accounting software designed for taxi driver businesses. Covers the specific income and expense categories relevant to taxi and private hire work, producing the figures needed for your self assessment tax return.

Payslips

Payslip software for producing employee payslips. Available in versions supporting up to 5, 10, or 20 employees, and integrated with the Company Accounts product.

Spreadsheet Screenshots